Basic Economics Overview - Supply & Demand, GDP and what is "The Fed"

Although there are many interpretations, economics is basically “the study of what constitutes rational human behavior in the endeavor to fulfill needs and wants.”

In business, companies follow economic news to make decisions on what products to make or discontinue, when to hire or lay off employees, build or sell a factory, spend more or less on advertising, etc. Economics is a vastly huge subject and can go into a world of theories and complicated mathematical formulas. We will, however, cover some of the basics.

The foundation of economics is Scarcity, which refers to the tension between our limited resources and our unlimited wants and needs. Scarcity is the basic economic problem that arises because people have unlimited wants, but resources are limited. Because of scarcity, various economic decisions must be made to allocate resources efficiently. These decisions are made by giving up, or trading off, one want to satisfy another. For an individual, resources include time, money and skill. For a country, limited resources include national resources, capital, labor force, and technology. The most common phrase that you have probably heard regarding economics is, “Supply and Demand.”

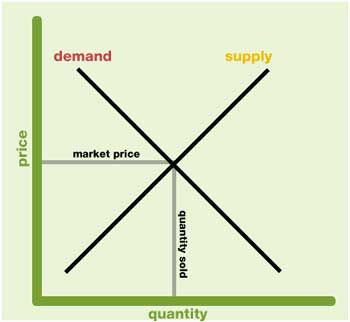

Supply is the quantity of a product produced and offered for sale. The more buyers are willing to pay, the more incentive to increase the supply. On the other hand, the less that buyers are willing to pay, the more incentive to lower the price to decrease the surplus. For example, if the quantity supplied of the product is 30, and the quantity demanded for the product is 20, there would be a surplus of 10 products (30-20=10). The sellers would have to lower the price in order to sell excess supply.

Demand is based on price. The law of demand is basically; as price increases people are willing to supply more and demand less and vice versa when the price falls. The optimal is to have equilibrium where the price point for the quantity supplied is in balance with the quantity demanded.

When the price is just right with no surplus and no shortage, supply and demand is known to be in Equilibrium. This means that the quantity demanded equals the quantity supplied. This is what economists use to look at regarding supply and demand for a product. A product is in equilibrium when the market price is set just right. If the market price drops, demand will exceed supply, thus prices will rise. If the market price increases, supply will exceed demand and prices will drop.

Two branches of economics are Microeconomics and Macroeconomics. Microeconomics is the study of the decisions of individuals, households, and businesses in specific markets, whereas macroeconomics is the study of the overall functioning of an economy such as basic economic growth, unemployment, recession, depression, or inflation.

Microeconomics focuses on supply and demand and other forces that determine the price levels seen in the economy. It analyzes the market behavior of individual consumers and firms in an attempt to understand the decision-making process of firms and households. It studies the shifts in demand based on income and other consumer factors. An increase in income normally leads to an increase in the amount people are willing to pay for goods, thus are more prone to buy more luxury items. There are also competing substitute products or services, which can lower the price of the original.

Macroeconomics focuses on the national economy as a whole and provides a basic knowledge of how things work in the business world, for example, the impacts of money supply, interest rates, unemployment, and government deficits.

The way we usually measure the size of an economy is by its Gross Domestic Product or GDP. GDP is the value of all the goods and services produced within our borders in one year. People who study macroeconomics would be able to interpret GDP figures and how they relate to our national economy. Basically, GDP measures the size of the national economy by the total value of all goods and services produced within a nations border. This is a key economic indicator for economic growth rate, which measures how much bigger or smaller an economy is one period, compared with the same period a year ago. The formula used, and a brief explanations of the components measured in GDP, is:

- GDP = C + I + G + (Ex – IM). C is for Consumption (household spending), I is for Investments (business spending), G is for government (federal, state and local spending). "Ex" is for Export (goods shipped out of the country that made them) and "Im" is for Import (goods shipped into the country that outside countries made). You can see that if any component increases, the total GDP increases. If any component decreases, the total GDP decreases. There is a never-ending business cycle, which is a long-run pattern of economic growth and recession, also known as boom and bust, because of fluctuations in demand. Recovery always follows recession, and vice-versa. A business cycle is like the domino effect: During a recovery, consumers buy more (C or Consumption), which then means businesses invest more in equipment and staff (I or investments), etc. During a recovery, the business cycle is on an upswing and GDP growth continues. During a recession, the exact opposite is true. This is important to know because as manager, you do not want to get stuck with excess inventory or hire un-needed additional staff because you didn’t see the economic slowdown coming, or vice-versa because you do not have the goods to sell due to an increase in demand.

The Federal Reserve, also known as “the Fed,” controls the U.S. money supply. It is the central banking system of the United States. It replaces old currency with new currency, guarantees bank deposits, and governs the banking system. The Fed affects the economy by moving interest rates, selling and buying government securities, and talking about the economy (known as “moral suasion”). The Fed manages two kinds of economic policy:

- Fiscal policy, which is the spending and taxation to stimulate or “cool” the economy by adjusting taxes and spending. It can raise or lower spending and raise or lower taxes. Using an increase in government spending to ignite a recovery is called fiscal stimulus. If the government spends more than it collects in taxes, it is deficit spending. The government can lower taxes as well to ignite a recovery instead of increasing spending. The government can do the exact opposite if it sees inflation heading upward to cool off the economy by raising taxes or reduce spending.

- Monetary policy, which uses interest rates, purchases, and sales of government securities to heat or cool the economy. The Fed sets the rate for short-term loans that banks make to one another, called the Fed funds rate, and the rate that the Fed makes with loans to banks, called the Discount rate. These tend to drive other interest rates. If interest rates are decreased, that makes for easier credit to start spending and increase demand, which also makes it easier to repay the loan. If it starts to overheat heading towards inflation, then the opposite is true to cool down the economy. The Fed can also sell government securities, which are bonds or government debt, to cool an economy. The government has the consumers and businesses money, which means there is less in circulation, thus less spending and less economic growth, which would result in reducing inflation. If the Feds want to heat up the economy, they buy back the securities, then cash will be back in the consumer and businesses hands to spend, etc.

At the end of the day, the government wants a sound currency, low unemployment, and sustained economic growth.

Here are some more economic terms, and key economic indicators or trends, which are commonly used:

o Bubble - When the price of an asset rises far higher than can be explained by fundamentals.

o Business cycle - The business cycle has four stages including expansion, peak, recession, and recovery. Lastly, recovery is what happens after security prices fall and eventually go back up.

o Capitalism – Economic system based on private ownership, production, and distribution of goods. It is based on “Free Enterprise,” which means the government should not interfere with the economy. It’s about competition for profit.

o Consumer Confidence – A psychological view from consumers on how they feel about the economy and their prospects in the current and future economy.

o Depreciation - A fall in the value of an asset or a currency; the opposite of appreciation.

o Depression – A bad, depressingly prolonged recession in economic activity. The textbook definition of a recession is two consecutive quarters of declining output. A slump is where output falls by at least 10%; a depression is an even deeper and more prolonged slump.

o Housing Starts – The start of construction on new homes is an economic indicator. This is due to declining housing also means declining purchases that goes with a new home such as carpeting, appliances, drapes, electronic equipment, and labor such as painting and landscapers. There is a domino effect when housing sales are slow for both new homes and existing homes.

o Inflation - Rising prices, across the board. Inflation basically means your dollar does not go as far as it used to as it erodes the purchasing power of a unit of currency. It is usually expressed as an annual percentage rate of change. If prices raise gradually, consumers can adjust. However, rapid inflation can destabilize the economy. Prices and inflation are key economic indicators.

o Pareto principle (also known as the 80-20 rule) – This states that eighty percent of result is obtained due to 20 percent of actions. For example, 20% of the people own 80% of the wealth, or 20% of the sales force contributes to 80% of all revenue, etc. This rule can be used in just about any situation. For example, 80% of your better employees will only take 20% of your time to coach, thus the other 20% of your employees will take 80% of your time.

o Prime Rate – This is the rate on loans that a bank charges its most creditworthy corporate customers. This is set by several major New York banks. A sub-prime rate is for such companies or individuals that don't meet criteria of best market rates and have a history of deficient credit. Interest rates are a key economic indicator.

o Recession - A period of decline in a national economy over a period of time, usually two quarters of a financial year. Spending and demand decrease, making the economic climate more difficult.

o Securities - Financial contracts, such as:

Bonds, which is basically an IOU that states that if an investor lends money to the government or a corporation now, then they will pay your money back at a stated time in the future while making small interest payments to you along the way.

Shares, which is part ownership of a company.

Derivatives, which are financial assets that “derive” their value from other assets that grant the owner a stake in an asset. Such securities account for most of what is traded in the financial markets.

o Stock Market – Basically, a high or raising stock market indicates a recovery is in progress and a failing market indicates recession. The Dow Jones Industrial Average (DJIA) is based upon 30 extremely large blue chip U.S. corporations, such as GE, Microsoft, and Coca Cola, and is used as a key economic indicator.

o Unemployment Rate - The number of people of working age without a job is usually expressed as the unemployment rate, which is a percentage of the workforce. This is one of the key economic indicators. This rate generally rises and falls in step with the business cycle. The average goal is no lower than 4% and no higher than 8%. If it goes too much lower, then inflation usually occurs. If it goes too much higher, then the country could be headed towards a recession.

o Venture Capital (VC) – Private equity to help new companies grow. A valuable alternative source of finance for entrepreneurs, who might otherwise have to rely on a loan from a risk averse bank manager.

o Yield – The return on an investment expressed as a percentage of the cost of the investment.